Our CPD training will help you to identify

Our focus is to help both accountants and tax advisers to identify the hidden benefit which requires additional disciplines that can add value to your work.

As the legislation has changed a number of times over the years, there now needs to be a high level of due diligence to achieve the maximum benefit and it’s important to understand your client’s tax profile as timing could be crucial!

With our team of multi-skilled staff ranging from tax experts, chartered surveyors, and chartered accountants, we can help you to reach the maximum benefit that can result in repayments of tax and reduce future tax liabilities for your clients.

Practicalities

What to look out for and what to do.

Risks

Risk to advisors.

Opportunities

The opportunity for clients.

What is included in the training?

-

Understanding Legislation Affecting Commercial Property Transaction

-

CPSE.1 Section 32 & Contractual Requirements

-

How to Build a Robust Case

-

Questions and Feedback

-

In-House v Specialist

-

Section 198 Election

-

Criteria

Interested? Register your interest in our CPD Training

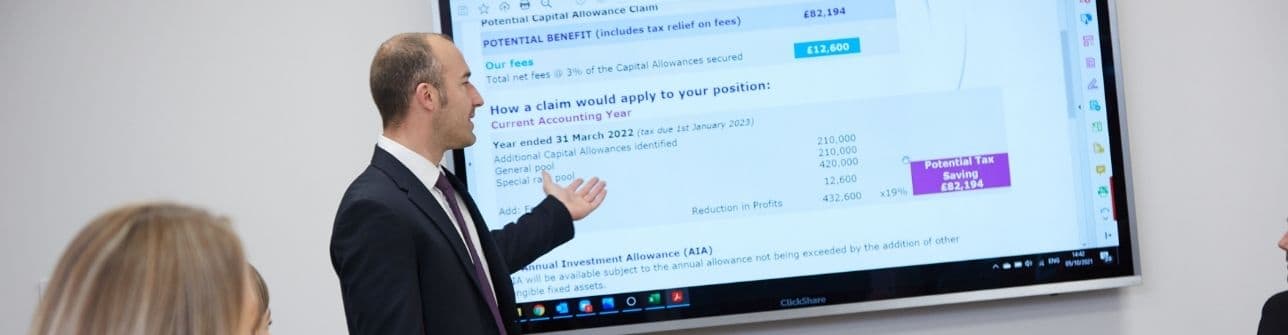

Case Study

CPD Training in Capital Allowances is crucial and as an accredited provider we can ensure you get the expert advice you need.

We recently worked with a Stoke-on-Trent Property Investor (vendor) who was embroiled in a dispute with their advisers over a commercial property transaction that went terribly wrong.

You can find out more by downloading our case study.