Structures and Buildings Allowance (SBA) explained

The structures and buildings allowance (SBA) is one of the most significant changes in capital allowances in recent years. Since the end of the Industrial Buildings Allowance (IBA), there has not been anything significant to replace that allowance.

What Qualifies for SBA?

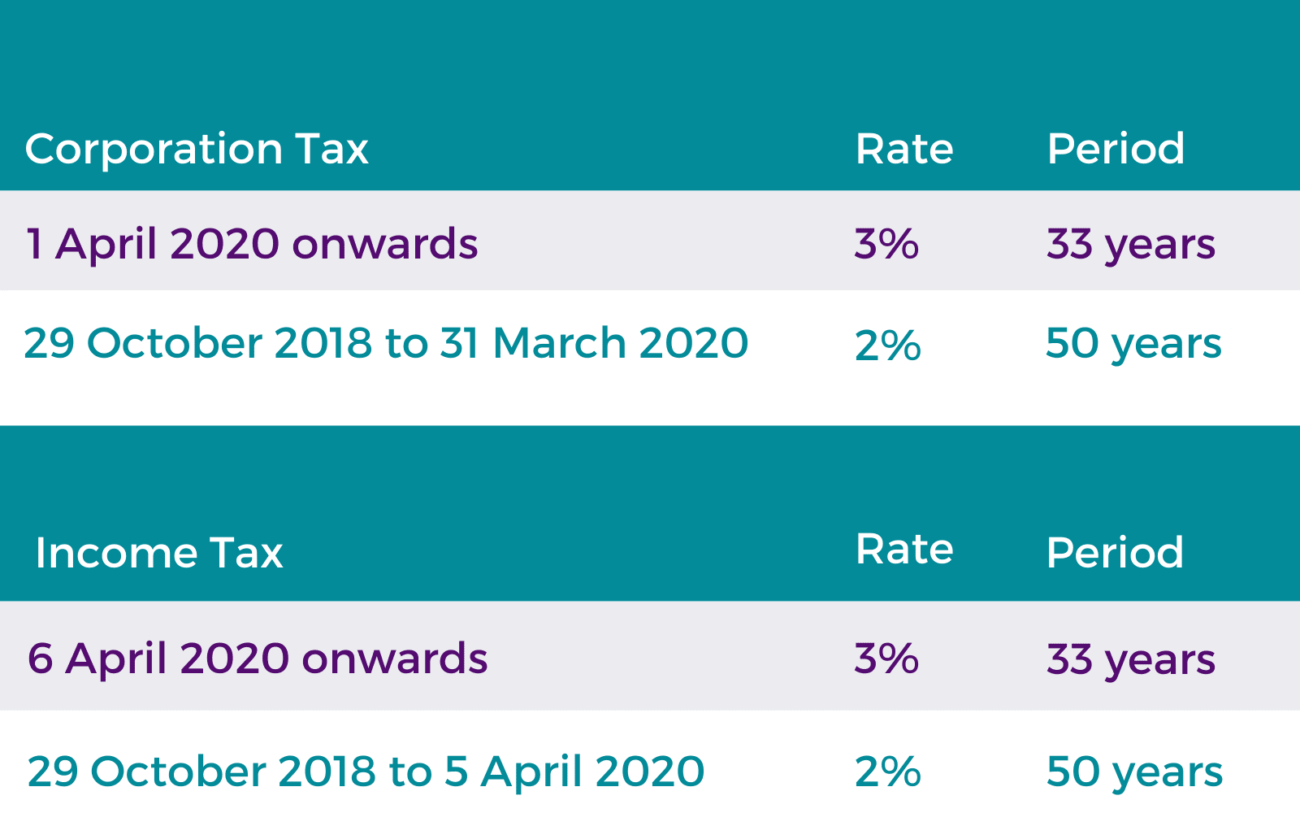

New construction on non-residential buildings is the primary qualifier for this kind of allowance. The allowance is calculated over 33 and third years and the rate is currently 3% per annum. It’s available for new properties that meet a specific kind of criteria, with the land element being ineligible for this allowance.

Be aware that new commercial structures and buildings can fall under the terms of this relief as well as creating a new conversion or renovation works.

The UK construction industry is seeing some huge changes. If you’re building in the UK or overseas, you can still potentially make a claim as long as you pay UK taxes.

Your 3% over a 33-year period will be limited to what it costs you to actually build the structure of the building. However, these costs could extend to demolition, land alterations, and any direct costs that create an asset in the first place.

What doesn’t qualify for SBA?

Assets such as plant, machinery, fixtures and fittings are not eligible for SBA, nor are integral features. These items continue to qualify for capital allowances, including the Annual Investment Allowance (AIA), and will continue to be calculated separately.

Download our example that shows how the introduction of Structures and Building Allowances (SBA) and how an increased Annual Investment Allowance (AIA) could be applied

What are the limitations of SBA?

- When you want to make your claims, you need to be aware that there are some limitations to this relief.

- A claim begins when the building or structure is bought into use, or when the work is completed if the building is in continuous use during the work carried out.

- The rights over your land or any land costs aren’t eligible for relief.

- Residential dwellings do not qualify for this relief. Even if you’re holding a mixed-use property where most of the structure is used as commercial, the part that is residential is prohibited and apportionment will apply.

- Renovating or converting a structure or building makes things complicated. If you’re doing so to make it a qualifying asset under these terms, you may end up qualifying for a separate relief.

Key Dates

This relief and allowance program has come into effect for projects that commence on or after 29 October 2018. Take the time to research the measure because the provisions for commencement are complex and unique. There are anti-avoidance measures that keep taxpayers from manipulating the relief.

If you entered into your contract before 29 October 2018, including any preparatory work, you might be disqualified. The physical construction works need to be agreed upon after that date if you want to ensure that you can qualify for this relief. It is worth noting that HMRC advise that they will classify even an email as “contract” if it specifies that work will take place.

The relief becomes available from when the building or structure is bought into use, or when the work is completed if the building is in continuous use during the work carried out. There are further rules to consider if the building ceases to be used for a period of time.

July 2021 Update

An HMRC amendment states that if further assets are purchased upon which SBA is being claimed, then the date of purchase of the new assets should be shown on the Allowance Statement.