Time Restrictions

The legisation change in April 2014 created alot of confusion regarding if & when claims can be made.

In short, where a property was acquired pre April 2014, there is no time bar for retrospective claims, meaning a claim started today could take into account years of investment in property.

Capital Allowances available for property transactions post April 2014 may have a 2 year window of opportunity (from completion), for all or part of the claim. It is therefore often wrongly assumed claims are not possible for transactions that took place more than 2 years ago.

In the event we were not involved in the purchase or sale of a property, even where the transaction took place more than 2 years ago, we always stress the importance of reviewing the transaction as often Capital Allowance claims are not time restricted.

As a side noted, there is no time restriction for claims made against property improvements, extensions and refurbishments.

Capital Gains Tax

Probably the most commonly heard misconception is the view that any savings achieved by claiming Capital Allowances will be cancelled out later by an increased chargeable gain (if, of course, the property is ever sold). That this is not true is made clear by s41(1) Taxation of Chargeable Gains Act 1992 (TCGA 1992), which says “Section 39 shall not require the exclusion from the sums allowable as a deduction in the computation of the gain of any expenditure as being expenditure in respect of which a Capital Allowance or renewals allowance is made” (s39 TCGA says “any expenditure that would be an allowable deduction when calculating an income or corporation tax liability may not be deducted when computing a capital gain”).

Section 41 TCGA 1992 therefore specifically provides that it is not necessary to deduct any Capital Allowances from the cost of an asset for capital gains purposes, so it is not possible for a Capital Allowance’s claim to create or increase a chargeable gain. Furthermore, claiming Capital Allowances also has no effect on the calculation of any Capital Gains Indexation Allowance that may be claimed.

Capital Allowance claims on Land and Buildings do not reduce their Balance Sheet value. This means when you sell the property Capital Gains are based on the original cost shown in the Balance Sheet.

Legislation Changes

In 2014 there was a significant legislation change resulting in many thinking property embedded capital allowances no longer existed. This is an example of how changes in legisation create uncertainty and oversights resulting in significant tax breaks note being ustilised. In recent years we’ve since the introduction of Structures & Buildings Allowances (SBA), Super Deduction and changes to Enhanced Captial Allowances (ECA’s).

You can see the number of changes in legsiation affecting Capital Allowances since 19xx here.

The updates, introductions and changes to legislation create a complex subject that is often misunderstood and under estimated.

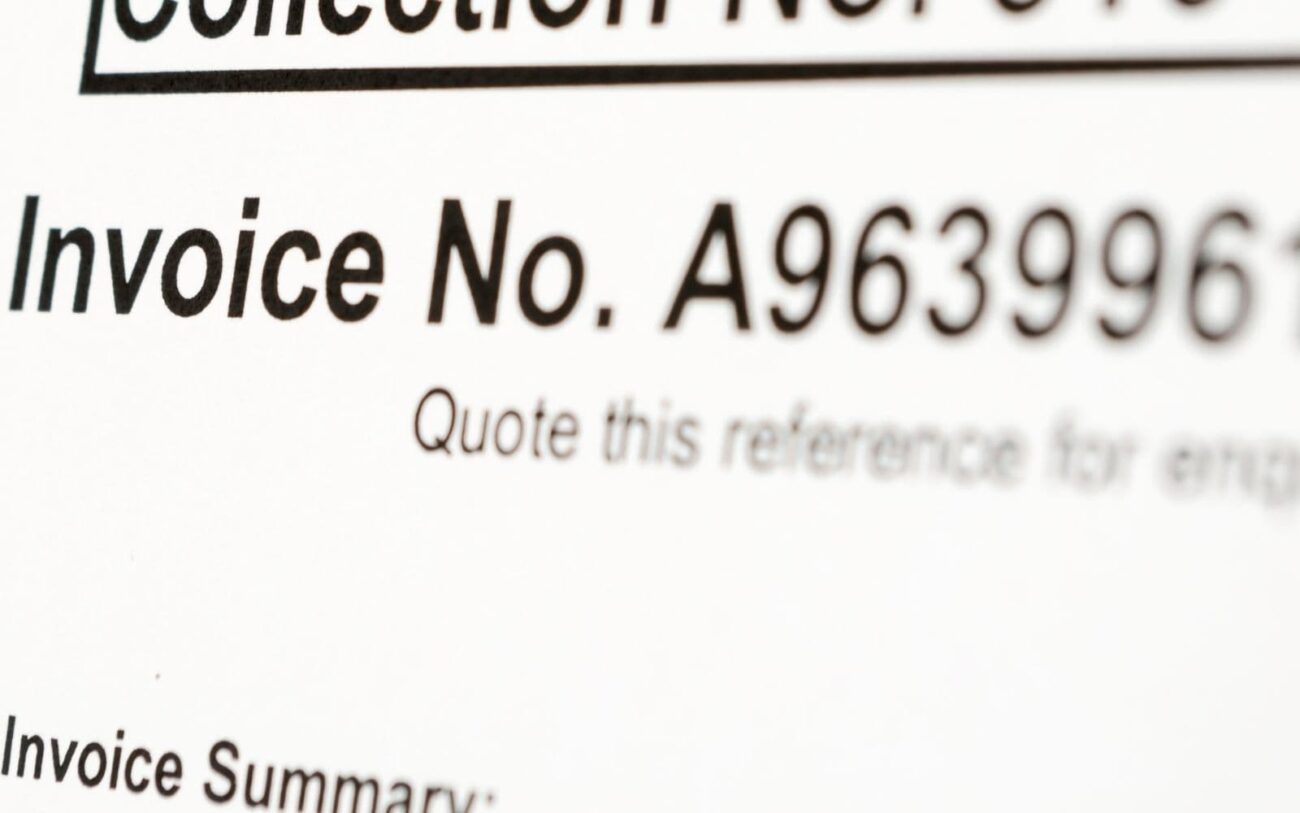

Lack of available invoices

It is often thought that without details invoices, claims can not be made. It is actually often the case that no invoices are available. The fact invoices may not be available does not create a problem and one of the main reasons our process is required.

Where proof of expenditure can not be confirmed via an invoice, there are other ways in which proof of expenditure can be confirmed in a way that ensures HMRC requirements are satisfied.

The Elephant in the Room

Functionality and Embedded are key to our approach

Plant & Machinery is not defined in law. This creates a misunderstanding and confusion about what does and doesn’t qualify and it is often assumed that all Capital Allowances have been claimed.

A key difference that we can offer is adding value to the work of a good but non-specialist Accountant, as an Accountant’s review normally begins and ends with analysing invoices and following the paper trail.

We will visit the property and identify the embedded items which are not available within the paperwork.