Only applies to:

-

Companies within charge to Corporation Tax

-

Covers expenditure incurred from 1st April 2021 to 31st March 2023

-

Only relates to new and NOT used/second-hand assets

-

Applies an enhanced first-year allowance (FYA)

Main Pool Rate

-

Property Embedded Fixtures and Fittings

-

Computer Equipment

-

Office Equipment

-

...And much more

Special Rate Pool

-

Solar Panels

-

Water Pipes

-

Electrical Systems

-

...And much more

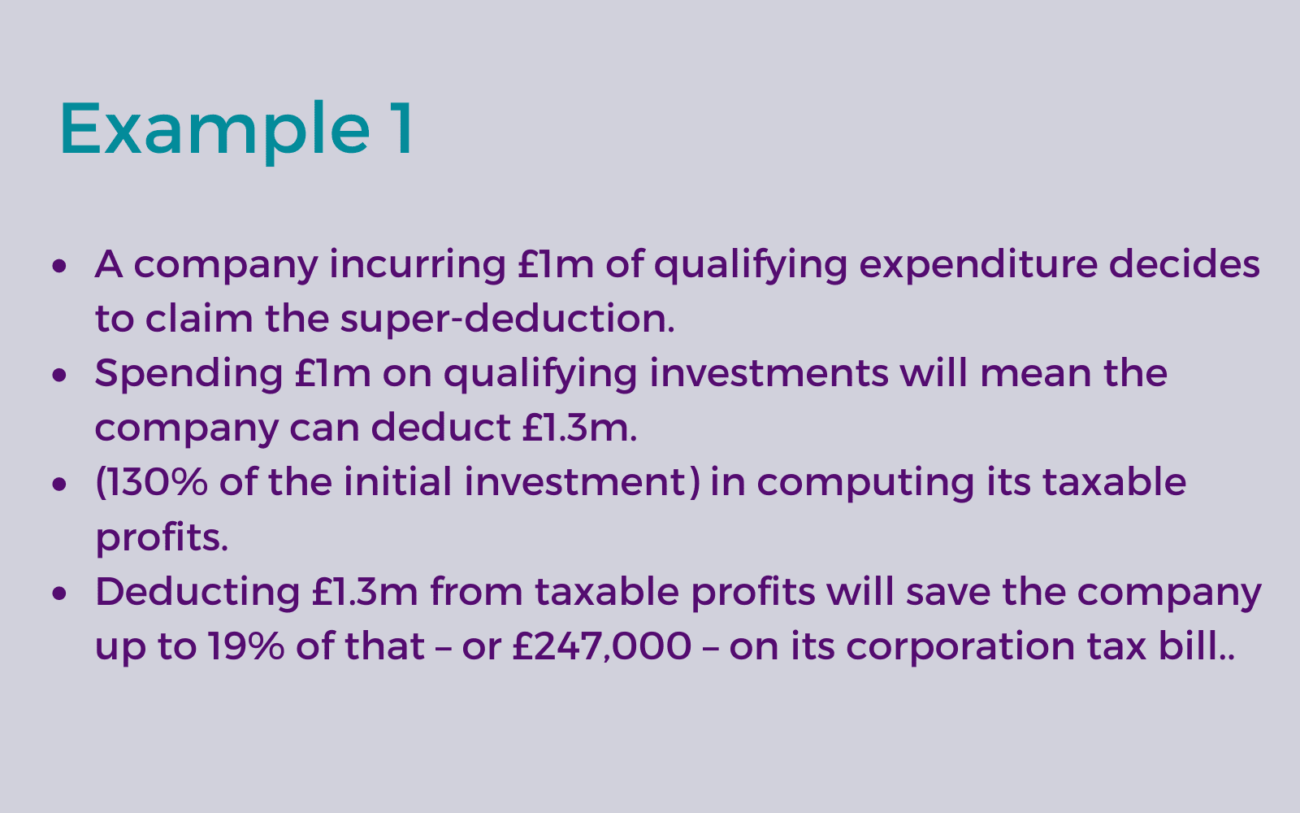

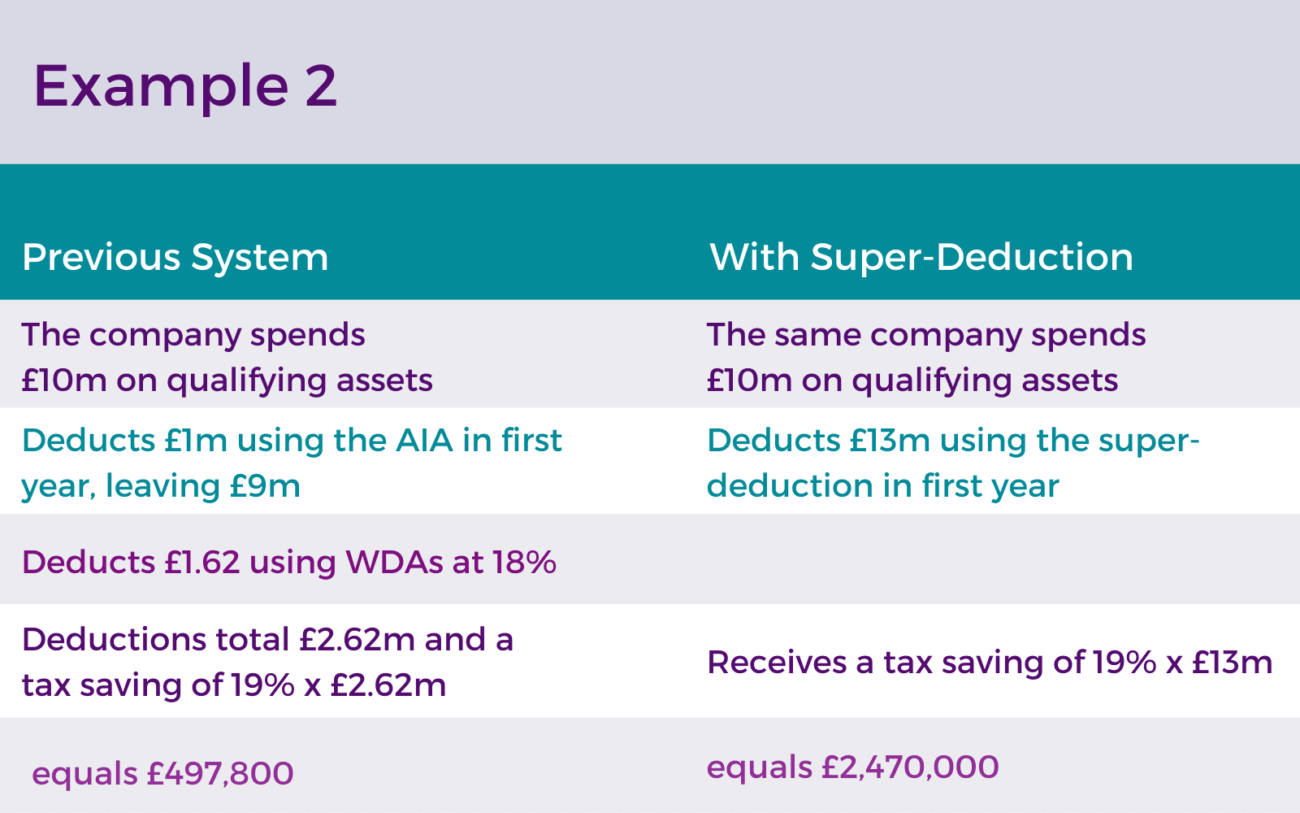

Businesses will now benefit from four significant capital allowance measures:

-

The super-deduction

That offers 130% first-year relief on qualifying main rate plant and machinery investments until 31 March 2023 for companies

-

The 50% first-year allowance

For special rate (including long life) assets until 31 March 2023 for companies.

-

Annual Investment Allowance (AIA)

Providing 100% relief for plant and machinery investments up to its highest ever £1 million thresholds, until 31 March 2023

-

Freeport Tax Sites

Companies can access new Enhanced Capital Allowances (ECA), and companies, individuals, and partnerships can benefit from an increased level of Structures & Buildings Allowance (SBA) for investments until 30 September 2026.

FAQ's

-

What qualifies for super-deduction?

Super-deduction can be claimed against many items of plant and machinery. The expenditure must have been incurred between 1 April 2021 and 1 April 2023.

-

What assets qualify?

Some examples of qualifying assets are:

Office furniture, computers, and warehouse machinery.

There are many more qualifying assets. Get in touch with our team to find out more.

-

When did super-deduction start?

On 3 March 2021 the government announced the new super-deduction tax relief to enhance investment within businesses. This is scheduled to end on 31 March 2023, limiting the time period companies have to benefit from this relief.

-

Is super-deduction for companies only?

Yes, this tax relief is only available to companies that are subject to Corporation Tax.