Important Note:

Here we look to help; however it’s important to stress that plant & machinery is not defined in law, and therefore a number of considerations need to be applied when assessing if & when business spend qualifies for capital allowances (e.g. trade, function, item, year of spend, legislation, etc).

Examples

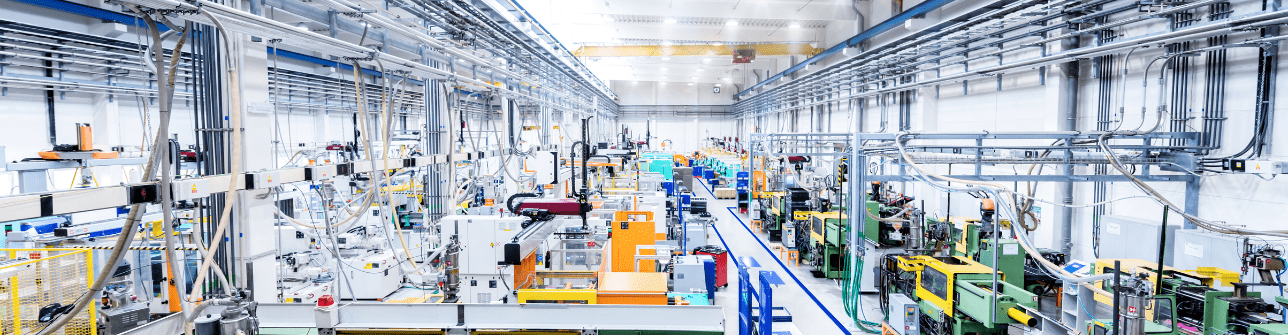

Assets that can often be classed as ‘plant and machinery’ are equipment like computers, office furniture, tools, machinery, etc, i.e. items that you use to keep your business running.

This could also include:

- The costs associated with demolishing plant and machinery equipment

- Some fitted fixtures and fittings e.g., fitted kitchens, washroom facilities, and CCTV systems

- Alterations to a building to install plant and machinery equipment

- Integral features e.g., lifts, air-con, water heating systems, lighting systems, etc

Items that do not typically qualify as ‘plant and machinery’ are:

- Items that are rented or leased

- Land

- Structures like bridges, and roads

- Building elements such as doors, gates, and mains connection charges

The 3 types of plant and machinery allowance that are most often used, are first-year allowances, annual investment allowance, writing-down allowances. Let’s take a look at these in more detail…

First-year allowances

First-year allowances allow businesses to maximise tax relief in a quick way. This type of allowance allows for a 100% deduction against profits incurred in the first year.

First-year allowance assets could include new:

- Research & Development Structures

- Super-deduction qualifying items

- Vehicle electric charging points

- Plant & machinery for gas refuelling stations

Annual investment allowances (AIA)

AIA currently sees 100% tax relief up to a total of £1 million annually. This is where you are able to deduct the full cost of assets from your profits before tax. Where this is claimed, the cost of the equipment is added to the relevant asset pool, and AIA claimed is deducted from that pool.

Writing-down allowances

This tends to be the default treatment where:

- first year allowances and AIA are not available,

- the thresholds for first year allowances and AIA have been exceeded,

- or first year allowances and AIA are missed due to timing.

Writing-down allowances (WDA) allow businesses to spread the tax savings over a number of years. Essentially, rather than crystallising the full tax savings in the year of spend, business are restricted to a % each year until the full cost have been written-down.

Asset pools for plant and machinery

Typically there are 2 main pools to consider when measuring your capital expenditure on plant and machinery, however there are more (for example short life/single asset pool).

- Main pool

- Special rate pool

Which pool an item falls into depends on the nature of the item, the life expectancy of the item, or even legislation.

Understanding these helps you to forward plan and manage spending by knowing what could be written off for each purchase made. Capital allowances are calculated at pool levels, rather than for each individual item.

Generally, plant and machinery items will fall into the main pool, whereas more embedded fixtures and fittings such as heating systems, air-con, or lighting, would fall into the special rate pool.

Who can claim for plant and machinery?

Capital allowances can be claimed by sole traders, partnerships, and companies. The main stipulations are that the business must own the asset, and the asset must be used for the purposes of the business at the end of the relevant period.

Specialist advice for plant and machinery allowances

Plant and machinery is not a subject which is defined by law. This makes obtaining final and specific answers, when it comes to the topic, difficult. However, at CARS, our team has years of experience, knowledge, and skills that they use daily to support businesses in getting the tax relief they are eligible for.

Call, or email us today to find out how our team can help your business.

-

11 April 2024

Land Remediation 2024: What Qualifies and What Doesn’t

Land remediation tax relief is a powerful incentive designed to encourage the rejuvenation of contaminated and certain derelict land. This is not only for environmental reasons but also for economic development. Understand what qualifies for this tax relief and what doesn’t, regarding Land Remediation...

-

6 March 2024

Spring Budget 2024: Changes to Capital Allowances

On Wednesday 6th March 2024, Jeremy Hunt, a key figure in fiscal policy, revealed the Spring Budget for the year. This announcement always demands the attention of businesses across sectors. As the dust settles, it becomes important to identify the changes that are going to impact the financial strategies...

11 April 2024

11 April 2024

6 March 2024

6 March 2024